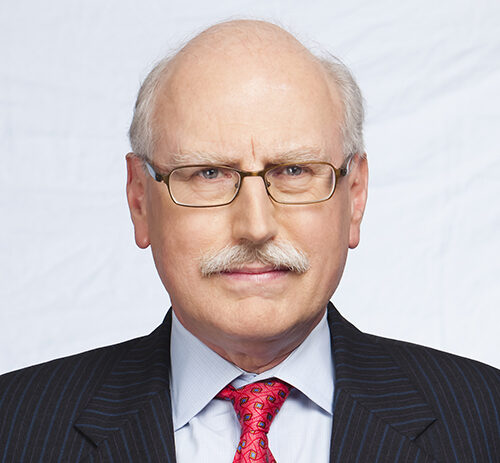

Mr. Kimball has a diverse practice touching on many areas of employee benefits law, tax law, corporate and general business law, and fiduciary law. He represents global companies engaged in a variety of businesses, such as manufacturing and extractive industries, consumer products and financial services, as well as closely held companies, investment firms, and not-for-profit entities. Areas of particular expertise include executive compensation (including representing employers in drafting and negotiating employment, non-competition, clawback, secondment and other senior executive agreements); bonus, incentive (both stock and non-stock based) and deferred compensation plans (including designing and drafting such plans); tax-qualified defined contribution and defined benefit retirement plans (including designing, drafting and obtaining governmental approval of such plans); ERISA and non-ERISA fiduciary issues (including advising boards of directors, compensation committees, retirement plan committees, trustees and other fiduciaries on their duties); ERISA, fiduciary and executive termination litigation; general tax (including representing businesses in connection with tax audits and litigation, providing transactional tax advice for businesses and individuals, and providing tax planning for high net worth families); not-for-profits (including drafting organizational documents and obtaining tax exemptions for not-for-profits and representing them in mergers and other corporate transactions); and business contracts (including drafting and negotiating licensing, asset purchase and sale, finder’s fee, consulting, supply and other commercial contracts, as well as LLC, partnership, shareholder and joint venture agreements).